On April 2, 2025, the U.S. shocked markets by imposing a 46% tariff on Vietnamese imports. Framed as a “Liberation Day correction,” the move sparked panic across export sectors, disrupted supply chains, and drew global headlines. The aggressive stance was one of the toughest U.S. tariffs ever applied to a key Asian partner.

Three months later, on July 2–3, the pressure gave way to diplomacy. After intensive negotiations, the two countries agreed to adjust the rate to 20%, effective August 1. This outcome, widely reported by Vietnam Briefing and international media, marked a major diplomatic win and highlighted Vietnam’s growing role in shaping the future of global trade.

April 2 Shock – The 46% U.S. Tariffs

The 46% tariff shook Vietnam’s major export industries—especially apparel, footwear, and electronics. Shipments were stalled, buyers paused orders, and sourcing strategies were reevaluated. Analysts compared this move to some of the harshest U.S. tariffs placed on other nations in recent decades.

VNO acted quickly. We supported clients by shifting toward value-added domestic production, diversifying inputs, and reinforcing local sourcing. These strategies softened the impact and ensured compliance under stricter customs checks.

Vietnam’s Diplomatic Response to U.S. Tariffs

Rather than retaliate, Vietnam doubled down on negotiation. From April to July, Trade Minister Nguyễn Hồng Diên and the Ministry of Industry and Trade engaged U.S. officials continuously.

Despite Trump initially rejecting a compromise, Vietnam persisted. Backed by international advisors, including Chatham House and Holland & Knight, Vietnam pushed for a balanced framework. The result: a new structure with a 20% standard rate and a 40% tariff on goods with suspected Chinese-origin transshipment.

This outcome allowed the U.S. to maintain its tough trade image while giving Vietnam space for growth. It showed that even under heavy U.S. tariffs, diplomacy could create workable solutions.

August 1 Adjustment – A 20% Tariff in Effect

As of August 1, the new 20% rate is live. According to analysts, Vietnam avoided the highest tier of U.S. tariffs and secured a roadmap for future reductions.

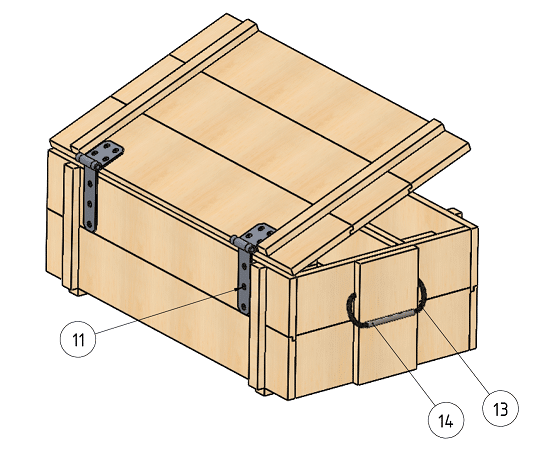

Key wins include:

-

Differentiating Vietnam’s goods from Chinese transshipment risks.

-

Maintaining competitiveness compared with other tariff-burdened nations.

-

Creating a foundation for continued tariff reviews.

Amid global protectionism, Vietnam emerged as a trade partner that negotiates confidently rather than passively accepting penalties.

Conclusion: Vietnam’s Strength Under U.S. Tariffs

2025 experience with Trump’s tariff on Vietnam shows how the nation has matured into a strategic, negotiation-savvy partner in world trade. For VNO clients, it proved the value of proactive risk management and adaptive sourcing.

By guiding clients through compliance, origin verification, and cost adjustments, VNO ensured stability in an uncertain climate. The 20% tariff is not just a policy shift—it is a turning point in Vietnam’s path toward trusted global leadership. More insight can be found at Compliance & Supply Chain in Vietnam.