Keep Delivering

- no 1902, A3 office, EcoLife building, To Huu Str, Hanoi, Vietnam

- info@vnoutsourcing.com

- +84 9 7979 6222

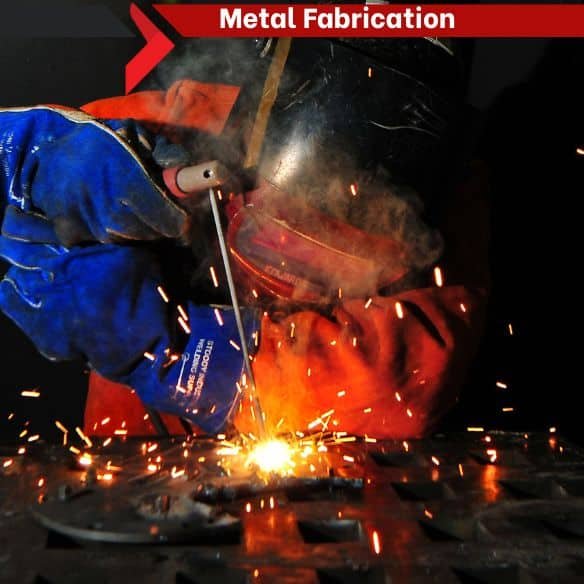

Metal Fabrication

Table of Contents

Introduction

Vietnam’s metal fabrication industry has become a key player in global manufacturing. With rising production costs in China and shifting trade policies in the United States and Europe, companies are seeking cost-effective, high-quality alternatives. Vietnam provides competitive labor rates, strong trade agreements, and a growing industrial base, making it a prime destination for outsourcing metal fabrication in 2025.

This guide explores the metal fabrication landscape in Vietnam, focusing on industry growth, competitive advantages, the impact of U.S. trade policies, and best practices for outsourcing. U.S. and European companies can leverage this information to optimize their supply chains and reduce manufacturing costs.

Industry Overview: Metal Fabrication in Vietnam

Market Growth and Trends

Vietnam’s metal fabrication sector has seen continuous expansion, driven by urbanization, infrastructure projects, and foreign investments. The market is projected to reach $6.0 billion in 2025, with a compound annual growth rate (CAGR) of 3.31% from 2025 to 2029. The demand for sheet metal, structural steel, and precision fabrication continues to rise, especially in the automotive, construction, and electronics industries.

Key Industries Driving Demand

- Construction: Prefabricated buildings, steel structures, and architectural metal components are in high demand.

- Automotive: Lightweight aluminum and stainless steel components are increasingly used in vehicle manufacturing.

- Aerospace and Defense: Precision metal fabrication supports the production of aircraft parts and defense equipment.

- Electronics: Custom enclosures and precision-cut metal components serve the growing electronics market.

Competitive Advantages of Metal Fabrication in Vietnam

Cost Efficiency

Vietnam offers one of the lowest labor costs in Southeast Asia, with wages significantly lower than China. The country’s competitive production costs allow U.S. and European companies to reduce expenses while maintaining high-quality output.

High-Quality Manufacturing Standards

Vietnamese manufacturers comply with international standards such as ISO 9001, ASTM, and CE certifications, ensuring quality assurance for global clients. Many facilities have adopted automation and CNC technology to improve precision.

Logistics and Trade Agreements

Vietnam benefits from trade agreements, including the EU-Vietnam Free Trade Agreement (EVFTA) and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). These agreements reduce tariffs and streamline export processes for metal fabrication products.

Vietnam vs. China vs. India: A Competitive Comparison

| Factor | Vietnam | China | India |

|---|---|---|---|

| Labor Cost (per hour) | Approximately $3.10 (2020) | Approximately $6.50 (2020) | Lower than China; specific rates vary |

| Trade Agreements | 18 active and planned FTAs | Active in several FTAs | 13 active FTAs as of 2025 |

| Supply Chain | Efficient and developing | Well-established | Developing |

| Quality Standards | High, with international certifications | High, with international certifications | Varies; improving |

| Tariff Impact | Lower; benefits from multiple FTAs | Higher; facing increased U.S. tariffs | Moderate; negotiating new FTAs |

Impact of U.S. Trade Policies on Metal Fabrication Outsourcing

New Tariff Regulations

In 2025, the U.S. government imposed a 25% tariff on imported steel and aluminum, significantly affecting global supply chains. Companies relying on Chinese metal imports face increased costs, prompting them to explore alternatives such as Vietnam.

The Fair and Reciprocal Tariff Plan

The Trump administration’s tariff strategy targets countries with trade surpluses with the U.S., including Vietnam. However, Vietnam’s existing trade agreements help mitigate the impact, keeping costs lower than competitors like China.

How U.S. and European Companies Can Adapt

Businesses can optimize their supply chains by:

- Partnering with Vietnamese manufacturers to bypass high tariffs.

- Utilizing trade agreements to access lower export costs.

- Working with certified suppliers to ensure compliance with international quality standards.

The Metal Fabrication Process in Vietnam

Step-by-Step Fabrication Workflow

- Material Sourcing: Procurement of steel, aluminum, and other metals from local and international suppliers.

- Cutting and Bending: CNC laser cutting and press brakes for precision shaping.

- Welding and Assembly: MIG, TIG, and robotic welding techniques for structural integrity.

- Machining: CNC milling and turning for custom components.

- Surface Treatment: Powder coating, anodizing, and galvanization for durability.

- Quality Control: Inspection processes to meet international certification standards.

- Packaging and Export: Logistics optimization for cost-effective shipping to the U.S. and Europe.

Selecting the Right Fabrication Partner

Key factors to consider when choosing a Vietnamese manufacturer include:

- ISO certifications and compliance with industry standards.

- Advanced manufacturing capabilities, such as CNC machining and automation.

- Strong logistics infrastructure for efficient exports.

- Proven track record with international clients.

Best Metal Fabrication Solutions for Different Sectors

Construction Industry

- Prefabricated steel structures

- Heavy-duty welding solutions

- Architectural metal components

Aerospace and Automotive Manufacturing

- Precision sheet metal fabrication

- Lightweight aluminum parts

- Advanced welding technologies for structural components

Industrial and Electronics Manufacturing

- CNC machining for precision metal parts

- Custom enclosures for electronics

- High-strength steel fabrication for industrial equipment

Case Study: U.S. Manufacturer Saves 35% with Vietnam Sourcing

Company Profile

A U.S.-based industrial equipment manufacturer faced rising costs due to increased tariffs on steel and aluminum. By shifting production to Vietnam, the company achieved a 35% reduction in manufacturing costs while maintaining high quality and timely delivery.

Key Takeaways

- Lower labor and production costs compared to domestic U.S. manufacturing.

- Compliance with U.S. and European quality standards ensured a seamless transition.

- Optimized logistics for cost-effective shipping.

Conclusion

Vietnam’s metal fabrication industry presents significant opportunities for U.S. and European companies seeking cost-effective, high-quality manufacturing solutions. With competitive labor costs, strong trade agreements, and a well-established supply chain, Vietnam is a leading alternative for metal procurement in 2025. As U.S. and EU trade policies evolve, businesses must stay informed and explore strategic partnerships with Vietnamese manufacturers to maintain a competitive edge.