Vietnam Outsourcing

The Potential for Outsourcing to Vietnam

In recent years, Vietnam outsourcing has gained worldwide attention as the country emerges as the “next manufacturing hub” after China. Many factors drive this shift.

Labor costs in Vietnam remain highly attractive, and the nation benefits from a favorable “golden population” structure — ideal for industrial development. Over 70% of Vietnam’s 90-million population is of working age, with a balanced gender ratio and healthy birth rate

(source: https://www.gso.gov.vn/lao-dong/)

Since the 1990s, global manufacturing giants have set up factories in Vietnam. Their presence, along with the steady improvement of vocational schools, has produced one of the most technically skilled workforces in Southeast Asia. Engineers and technicians trained locally now rival those in neighboring developing nations.

At the same time, the Vietnamese government continues to lead the region in trade liberalization. It has 16 Free Trade Agreements (FTAs) in various stages of implementation — with partners including the EU, South Korea, Japan, and the Eurasian Economic Union (source: Access Vietnam). These FTAs have positioned Vietnam as a gateway for global manufacturers seeking tariff advantages and flexible supply routes.

By 2017, the country attracted over $307 billion in registered FDI across more than 23,000 projects, with nearly 60% in processing and manufacturing. Meanwhile, new industrial zones and infrastructure investments continue to support this growth.

However, as the U.S.–China trade war disrupted global supply chains, Vietnam quickly became the most promising alternative. Yet, the question remains — can Vietnamese manufacturers truly capitalize on this opportunity?

The Stumbling Blocks in Outsourcing Vietnam

While outsourcing to Vietnam offers many benefits, several challenges persist. The country’s strongest manufacturing sectors — apparel, footwear, and woodwork — are still labor-intensive industries with low added value.

The electronics sector is growing rapidly, but most production is controlled by multinational corporations (MNCs). For instance, Canon has operated in Vietnam since 2012 but works with only 20 local suppliers out of 175, mostly for plastic and packaging. Key components remain imported from Japan, Taiwan, and China.

This reveals a major obstacle: the underdeveloped supporting industries. Building robust local supply chains takes time and expertise. Approving a new supplier can take 6–9 months for general manufacturing and 2–3 years for the automotive sector. Many Vietnam outsourcing companies still lack the systems and certifications needed to pass such stringent audits.

Moreover, while the “China+1” strategy attracts new investors, not every Vietnamese factory is prepared to deliver the quality, capacity, and consistency global customers expect.

Explore how shifting global supply chains shaped Vietnam’s industrial growth in 2023 — a defining year that set the stage for today’s Vietnam Manufacturing News and long-term outsourcing trends.

The Reality: Manufacturing Hubs Aren’t Built Overnight

Some international buyers assume moving their supply chains to Vietnam is quick and easy. In reality, building a reliable network of outsourcing partners in Vietnam takes time, technical training, and patience.

As Chris Mooney, Director of Chinaoutsourcing.com, explains:

“China has a population ten times larger than Vietnam and a 20-year head start in industrial capability. Almost everything you need for production is available locally. Vietnam is catching up, but that takes time.”

While Vietnam’s advantages — low labor costs and favorable FTAs — are real, they are also temporary. Rapid FDI inflows have already created a shortage of skilled technicians, pushing wages higher. The same FTAs that open export markets also increase competition at home, as local manufacturers must meet international standards to survive.

Simply put, Vietnam outsourcing cannot mature overnight. The ecosystem needs years of coordinated effort across education, infrastructure, and quality systems.

The myth of manufacturing costs in Viet Nam

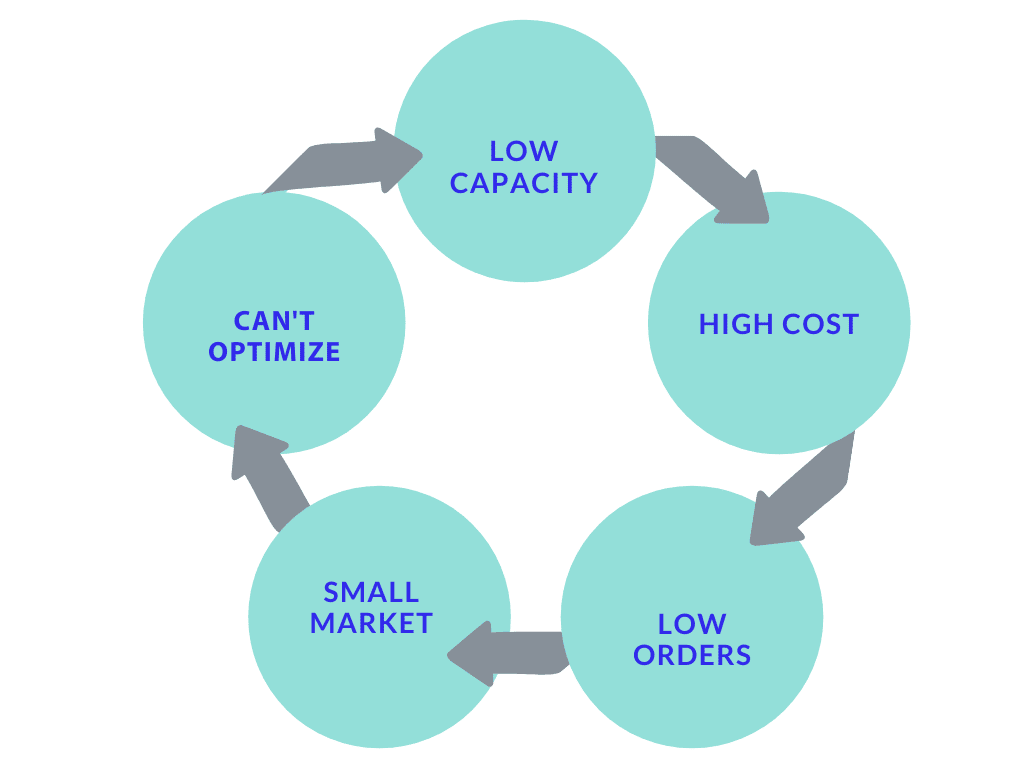

Despite its lower average wages, outsourcing Vietnam does not always guarantee cheaper production. Many Western companies are surprised to find that quotes from Vietnam outsourcing companies can be 1.5 to 2 times higher than China’s.

For example, an American company seeking to produce hydraulic torque wrenches discovered that no local supplier specialized in this product. Setting up a new production line meant investing in materials, tools, and training — pushing initial quotes nearly double those in China. Over time, costs can decrease through optimization, but early production remains expensive.

Another factor is mindset. Some Vietnamese manufacturers, especially state-owned or long-established private enterprises, focus heavily on traditional orders and short-term profits. They may lack motivation to compete internationally or adopt advanced management systems.

As Daniel Pham, Director of Vietnam Outsourcing (VNO), explains:

“Many factories rely on existing relationships. They’re comfortable with stable orders and rarely push for efficiency or pricing competitiveness. This mindset needs to evolve if Vietnam wants to move up the global supply chain.”

Furthermore, many factories struggle with accurate pricing. Unlike Chinese manufacturers, who apply market-driven pricing models, Vietnamese factories often rely on cost-plus formulas with high safety margins. Without detailed analysis of indirect costs, they tend to overestimate prices, reducing competitiveness.

How Vietnam Outsourcing Companies Can Improve

The fastest way for Vietnam outsourcing companies to improve is to learn from Western clients and experienced Asian peers. Stricter technical requirements and rigorous quality control systems, though challenging, can greatly enhance local competitiveness.

As Chris Mooney notes, Vietnamese factories can learn much from China’s approach to production organization, automation, and cost management. Applying such practices gradually will help optimize manufacturing efficiency and global positioning.

Meanwhile, Vietnam Outsourcing Pte Ltd (VNO) continues to bridge the gap between local factories and international buyers. As Daniel Pham shares:

“We work closely with factory owners who are ambitious and open to change. For example, we helped a factory in Dong Anh province set up new machining lines for precision copper components. It took seven months and three sample rounds, but the result met every technical and quality requirement.”

VNO’s engineering team transferred specialized materials and tools from China, while technical experts from both countries collaborated on process development. The result: the first successful batch of locally produced components that matched international standards.

Conclusion: Building the Future of Outsourcing Vietnam

Ultimately, developing Vietnam’s manufacturing capacity is a long-term process. Building strong local capabilities leads to more orders, better technology, and continuous improvement — a positive cycle that strengthens the entire ecosystem.

As Daniel Pham summarizes:

“The interest from Western customers in Vietnam outsourcing is real and growing. Vietnamese manufacturers must take initiative, improve production, and position themselves globally. Each factory’s effort contributes to the competitiveness of the whole industry. At VNO, we’re committed to helping local partners reach that level.”

While new factories and trading companies continue to emerge across Vietnam, only a few have the experience, expertise, and engineering depth to truly compete internationally. For global buyers, the key is to partner with top outsourcing companies in Vietnam — those who combine technical capability, supply chain knowledge, and a proven record of international collaboration.