Introduction: Vietnam Factories in the Global Supply Chain

In 2024, Vietnam factories play a critical role in global supply chains. Western companies are increasingly Sourcing to Vietnam to reduce costs and improve quality. However, navigating local regulations can be complex. From taxes to export requirements, understanding Vietnam’s rules ensures smoother operations and stronger compliance. More insight can be found at Compliance & Supply Chain in Vietnam.

Tax and Investment Rules for Vietnam Factories

Taxation and investment laws shape the business environment for Vietnam factories. Companies must pay attention to both costs and available incentives.

Corporate Income Tax (CIT)

The standard rate is 20%. However, Vietnam offers exemptions and reductions for high-tech, large-scale projects, and factories in special economic zones.

Value-Added Tax (VAT)

The VAT rate is 10% for most goods. Exported products from Vietnam factories, such as metal parts and machinery, qualify for 0% VAT—giving global buyers an advantage.

Import and Export Duties

Under trade agreements like EVFTA and CPTPP, many raw materials are duty-free. Finished products, such as sheet metal or hydraulic frames, often face no export duties.

Labor and Environmental Rules Affecting Vietnam Factories</h2>

Labor Compliance

Factories must follow labor codes that regulate hours, wages, and social insurance. In 2024, regional minimum wages range from $200 to $230 per month. Employers also contribute 17.5% of salaries to social insurance funds.

Environmental Compliance

Vietnam requires environmental impact assessments for large projects. Moreover, strict rules on emissions and waste apply to Vietnam factories</strong> in sectors like die casting and metal forming. Non-compliance may result in fines or suspensions.

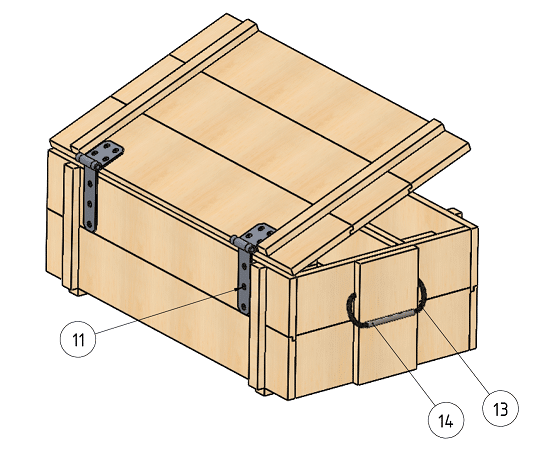

Export Documentation

To avoid delays, factories must provide:

-

Commercial invoice

-

Packing list

-

Certificate of Origin (CO) for tariff benefits

-

Bill of Lading (BOL)

Vietnam’s VNACCS system speeds customs clearance, but accuracy in HS codes and electronic submissions is critical.

Challenges

Complex Bureaucracy

Regulatory approvals may involve multiple agencies.

Solution: Work with local consultants who know the system.

Changing Regulations

Frequent updates can confuse global buyers.

Solution: Partner with Vietnam factories supported by compliance experts.

Cultural and Language Barriers

Miscommunication can delay shipments.

Solution: Use bilingual consultants to ensure smooth cooperation.

Case Studies: Compliance Success Stories

-

German Automotive Supplier: Partnered with Vietnam factories</strong> to produce EV parts. Local teams secured EVFTA tax benefits, reducing costs by 20%.

-

US Construction Firm: Outsourced roof jacks and valves. Procurement experts in Vietnam managed export documentation, cutting delivery times by 30%.

Conclusion

Understanding how Vietnam factories</strong> operate within the regulatory environment is essential for Western companies. From tax incentives to labor laws and export procedures, compliance ensures smoother supply chains and reduced risks. With trade agreements, improved infrastructure, and skilled consultants, Vietnam is a reliable partner for 2024 and beyond.