- June 16, 2022

- Daniel Pham

Everything you need to know about Aluminum Industry

Table of Contents

The aluminum industry has become one of the most essential sectors in global manufacturing. Lightweight, corrosion-resistant, and highly versatile, aluminum is used in industries ranging from automotive and aerospace to packaging, construction, and renewable energy. With growing demand for sustainable materials, the aluminum sector is expected to expand significantly over the next decade.

This guide provides a complete overview of the aluminum industry, including its history, production processes, major applications, global market outlook, and the latest updates on Vietnam’s growing role in aluminum manufacturing. For deep insight of Vietnamese market, you might want to read aluminum manufacturing in Vietnam

What is the Aluminum Industry?

The aluminum industry covers the entire value chain, from mining bauxite ore to refining, smelting, and downstream manufacturing processes such as extrusion, rolling, and casting. It also includes recycling, which plays a growing role in reducing carbon emissions.

Key segments of the industry include:

Primary aluminum production (bauxite mining, alumina refining, smelting)

Secondary aluminum production (aluminum recycling and re-melting)

Downstream manufacturing (extrusion, casting, rolling, and finishing)

Aluminum Production: From Ore to Finished Products

1. Bauxite Mining and Alumina Refining

Aluminum originates from bauxite ore, primarily mined in countries like Australia, Guinea, and Brazil.

The ore is refined into alumina (aluminum oxide), which is then used in the smelting process.

2. Smelting Process

The Hall-Héroult process is the dominant method for producing primary aluminum.

This process requires large amounts of electricity, making energy efficiency critical to the industry.

3. Extrusion and Casting

Aluminum extrusion involves forcing heated aluminum through a shaped die to create long profiles used in construction, automotive, and electronics.

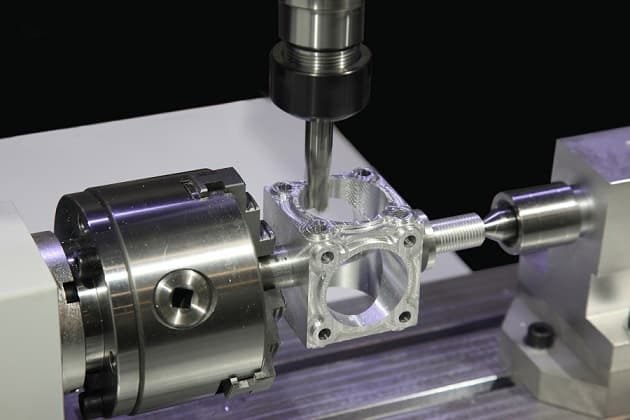

Aluminum casting manufacturers produce complex parts for aerospace, automotive, and industrial machinery.

4. Recycling

The recycling of aluminum requires only 5% of the energy compared to primary production.

This makes it a cornerstone of the industry’s sustainability efforts and a key factor in reducing CO₂ emissions.

The Vietnam Aluminum Industry: A Growing Global Hub

In recent years, Vietnam has emerged as a rising player in the global aluminum industry, especially in extrusion and casting. While Vietnam does not produce primary aluminum at the scale of China, its strength lies in downstream manufacturing and its role as a “China+1” alternative for global buyers.

Key Developments in Vietnam’s Aluminum Industry

Aluminum Extrusion Manufacturers: Vietnam is home to over 100 aluminum factories specializing in extrusion, serving construction, automotive, electronics, and solar energy industries. Many aluminum extrusion suppliers in Vietnam are ISO-certified and export-ready.

Aluminum Casting Manufacturers: Growing demand from automotive and industrial equipment sectors has led to the expansion of aluminum casting manufacturers across northern and southern Vietnam.

High-Grade Alloys: Several Vietnamese suppliers are now positioning themselves as 7075 T6 aluminum suppliers, meeting demand for aerospace and defense-grade alloys.

Geographic Clusters: The north (Hanoi, Bac Ninh, Hai Phong) is known for precision engineering and casting, while the south (Ho Chi Minh City, Binh Duong, Dong Nai) hosts larger extrusion plants serving construction and industrial markets.

Export Markets: Vietnam’s aluminum exports have grown steadily, with the U.S., EU, and Japan as primary destinations. Despite tariffs (20% U.S. duty on certain aluminum imports in 2024), Vietnam’s cost advantages and compliance with international standards keep it competitive.

Strengths of Vietnam’s Aluminum Industry

Cost Advantage: 10–20% lower costs than China and India for small-to-medium orders.

Flexibility: Willingness to handle low- and mid-volume custom extrusion and casting projects.

International Standards: Many suppliers comply with ISO 9001, ASTM, RoHS, and REACH, making them export-ready.

Government Support: Incentives for industrial modernization and foreign investment in advanced manufacturing.

Challenges Facing Vietnam’s Aluminum Sector

Scale Limitations: Most factories are mid-sized compared to large Chinese competitors.

Raw Material Dependency: Vietnam imports bauxite and alumina for production, making costs sensitive to global price fluctuations.

Technology Gaps: Some aluminum factories still rely on older equipment, though modernization is ongoing.

Despite these challenges, Vietnam is steadily strengthening its role as a reliable partner for aluminum extrusion and casting in global supply chains.

Global Market Overview

The global aluminum market was valued at $172 billion in 2024 and is projected to exceed $220 billion by 2030, with a CAGR of 4–5%.

Asia-Pacific: Dominates production, with China producing over 50% of the world’s aluminum.

North America & Europe: Focus on high-value alloys, recycling, and downstream applications.

Vietnam & Southeast Asia: Growing rapidly as aluminum extrusion manufacturers and aluminum casting suppliers scale up to serve U.S. and EU markets.

Major Applications of Aluminum

The aluminum industry serves multiple sectors:

Automotive & Aerospace: Lightweight aluminum alloys improve fuel efficiency and reduce emissions.

Construction: Aluminum extrusions and sheets are widely used in windows, doors, roofing, and facades.

Electronics: Heat sinks, enclosures, and casings are essential components.

Renewable Energy: Aluminum is key in solar panel frames, wind turbines, and battery enclosures.

Packaging: Beverage cans and food packaging rely on aluminum for durability and recyclability.

Key Trends Shaping the Aluminum Industry

1. Sustainability and Recycling

Recycling now accounts for over 30% of global aluminum production. Vietnam is investing in recycling facilities to meet U.S. and EU buyers’ sustainability requirements.

2. Advanced Alloys

Vietnamese suppliers are increasingly producing 7075 T6 aluminum, catering to aerospace and defense markets that demand high strength-to-weight ratios.

3. Digital Manufacturing

Factories in Vietnam are adopting CNC machining, automation, and digital quality control to increase competitiveness and traceability.

4. Trade and Tariffs

With U.S. tariffs on China still in place, Vietnam remains attractive under the “China+1” model. However, buyers must stay updated on tariff policies for aluminum imports.

Strengths and Challenges of the Aluminum Industry

Strengths:

Lightweight and corrosion-resistant material

High recyclability with minimal energy use

Expanding demand in automotive, aerospace, and energy sectors

Challenges:

High energy consumption in primary production

Price volatility tied to global energy markets

Trade restrictions and tariff uncertainty